In today’s fast-paced business world, managing payroll efficiently is more than just a necessity—it’s a crucial element for maintaining employee satisfaction, regulatory compliance, and overall organizational health. Paycor, a leader in HR and payroll solutions, stands out as one of the top platforms for businesses looking to streamline their payroll processing. With decades of experience, Paycor has earned the trust of thousands of organizations for its powerful tools, user-friendly interface, and comprehensive features. This article provides an in-depth look at Paycor payroll, its key features, benefits, and how it helps businesses of all sizes manage payroll seamlessly.

What is Paycor Payroll?

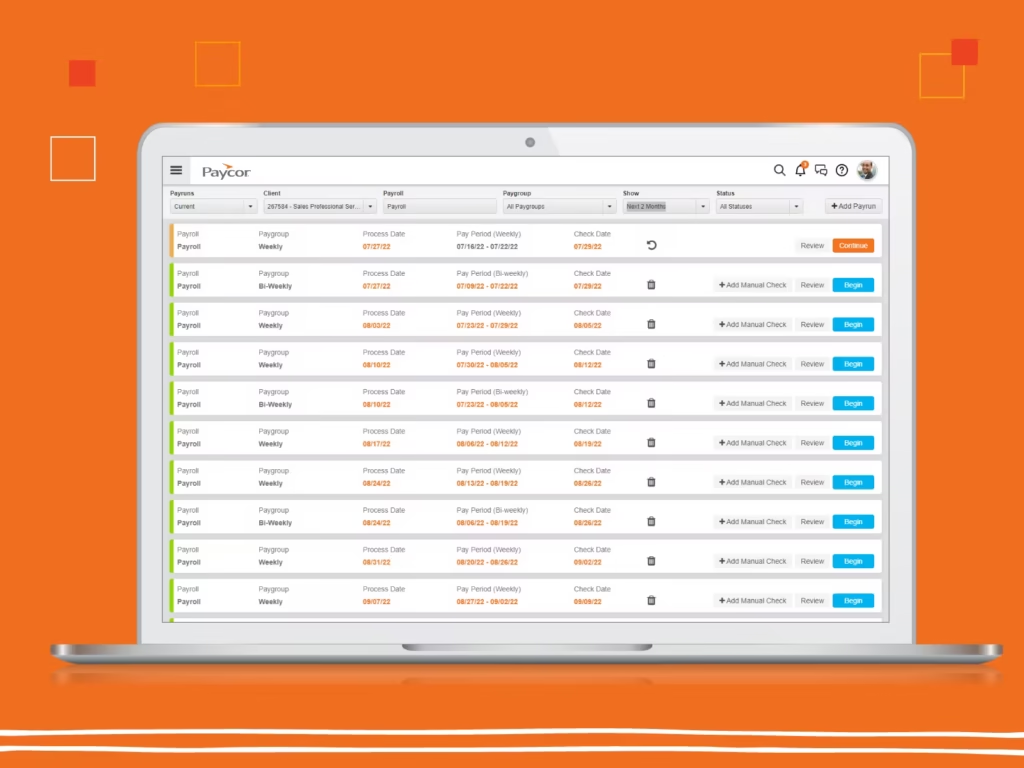

Paycor payroll is a cloud-based payroll solution designed for businesses of all sizes. It enables organizations to handle various payroll-related tasks, from calculating employee salaries to managing deductions, taxes, and benefits. With its easy-to-use platform, Paycor simplifies complex payroll processes, allowing HR and finance teams to focus on other critical tasks. The solution integrates with other HR tools within the Paycor ecosystem, making it an all-in-one solution for HR, talent management, and payroll.

One of the standout features of Paycor Payroll is its adaptability. It can be tailored to meet the unique needs of any business, from small startups to large enterprises. The platform supports various industries, offering customizable payroll options, compliance management, and time tracking, all in one seamless system.

Key Features of Paycor Payroll

1. Automated Payroll Processing

At the heart of Paycor Payroll is its ability to automate payroll processing. Payroll can be run in just a few clicks, ensuring accuracy and saving significant time. Once the setup is complete, Paycor handles the rest—calculating hours, deductions, taxes, bonuses, and other compensation elements. The platform provides businesses with a reliable, error-free payroll solution that minimizes the risk of human mistakes, which are common in manual payroll processing.

2. Compliance and Tax Management

One of the biggest challenges companies face when processing payroll is staying compliant with ever-changing federal, state, and local regulations. Paycor Payroll is designed to stay up-to-date with the latest tax rates and regulations, ensuring that businesses comply with all legal requirements. The system automatically calculates the appropriate tax withholdings and generates the necessary forms for tax reporting, reducing the risk of errors and fines.

3. Employee Self-Service Portal

Employees are at the heart of any business, and Paycor Payroll offers an employee self-service portal that allows workers to manage their own payroll information. Employees can access their pay stubs, update personal information, view tax forms, and even request time off directly from the portal. This self-service capability empowers employees to stay on top of their payroll information and reduces the administrative burden on HR teams.

4. Direct Deposit and Payment Options

Paycor Payroll offers multiple payment methods, including direct deposit, ensuring that employees receive their payments quickly and securely. The platform allows businesses to set up direct deposit for their entire workforce, providing an efficient and reliable payment method that eliminates the need for paper checks. Employees can also opt for different payment frequencies—weekly, biweekly, or monthly—depending on the company’s payroll cycle.

5. Real-Time Reporting

In business, timely and accurate reporting is crucial for making informed decisions. Paycor Payroll offers real-time reporting that provides a clear picture of your payroll data. This includes insights into labor costs, tax liabilities, and overall payroll expenditures. Business owners and HR professionals can generate customized reports based on their specific needs, helping them make more strategic decisions and optimize payroll-related processes.

6. Mobile App

In addition to its desktop platform, Paycor offers a mobile app that provides on-the-go access to payroll information. Whether it’s for approving timesheets, processing payroll, or accessing pay stubs, the Paycor mobile app ensures that business owners and employees can stay connected to their payroll details from anywhere. The app supports both iOS and Android devices, offering a user-friendly experience.

7. Integration with HR and Time Management Tools

Paycor Payroll is not just a standalone payroll solution; it integrates seamlessly with other Paycor HR and time management systems. This ensures that payroll, employee data, time tracking, and benefits management are all in sync, eliminating the need for duplicate data entry. Businesses can easily track employee hours, overtime, and attendance, making payroll processing even more efficient. Moreover, Paycor’s system integrates with third-party applications, offering greater flexibility for companies that use other tools in their workflows.

8. Customizable Payroll Options

Paycor Payroll offers customizable payroll solutions that cater to businesses with unique needs. Whether you’re handling salaried employees, hourly workers, contractors, or commission-based staff, Paycor provides flexible payroll options that adapt to your specific compensation structure. The platform supports multiple pay types, including shift differentials, bonuses, and commissions, allowing businesses to accommodate a wide range of compensation structures.

Benefits of Paycor Payroll

1. Time and Cost Savings

With its automation capabilities and user-friendly interface, Paycor Payroll saves businesses significant time and resources. Payroll tasks that once took hours to complete manually can now be done in a fraction of the time. The reduction in administrative overhead allows HR and finance teams to focus on more strategic tasks, such as employee engagement, talent acquisition, and overall business growth.

2. Error Reduction

Manual payroll processes are prone to errors, such as miscalculations, missed deductions, or incorrect tax withholdings. Paycor’s automated payroll system significantly reduces the risk of such errors. The system performs calculations accurately and ensures that all compliance requirements are met, which in turn helps prevent costly mistakes and penalties.

3. Enhanced Employee Satisfaction

Paycor Payroll enhances the overall employee experience by providing timely and accurate pay, offering self-service options, and giving employees access to their payroll data anytime and anywhere. Employees can easily track their earnings, view tax forms, and make updates to their information, leading to improved satisfaction and trust in the organization.

4. Scalability

As a cloud-based solution, Paycor Payroll can scale with your business. Whether your company is growing rapidly or undergoing restructuring, Paycor adapts to your changing needs. You can easily add new employees, change pay structures, and accommodate business expansions without the hassle of upgrading your system or software.

5. Security and Data Protection

Paycor takes security seriously. The platform is built with robust data protection features, including encryption and secure servers, to ensure that sensitive payroll data is safeguarded. Regular audits and compliance checks are conducted to meet industry standards for data security. Businesses can rest assured that their employee payroll information is secure and protected from unauthorized access.

Pricing and Plans

Paycor offers a flexible pricing model based on the needs of the business. The platform’s pricing varies depending on the size of the organization, the number of employees, and the specific features needed. Paycor’s solutions are priced competitively, making it an attractive option for businesses of all sizes. Additionally, Paycor offers a range of add-ons, allowing companies to tailor the system according to their requirements.

Why Choose Paycor Payroll?

Paycor stands out in the crowded field of payroll solutions due to its comprehensive features, scalability, and commitment to providing excellent customer support. By automating key payroll processes, offering robust compliance management, and delivering real-time insights, Paycor empowers businesses to focus on what truly matters—growing their workforce and their bottom line. Whether you’re a small business owner or managing a large enterprise, Paycor Payroll can help you streamline payroll processing and ensure your employees are paid accurately and on time.

Conclusion

Paycor Payroll is an innovative and reliable solution for businesses looking to simplify and automate their payroll processes. With its comprehensive features, real-time reporting, mobile app, and seamless integration with other HR tools, Paycor is well-positioned to meet the payroll needs of modern businesses. It is an ideal choice for organizations looking for a scalable, secure, and efficient payroll management solution that can evolve with their business over time. By choosing Paycor, businesses can reduce administrative burdens, increase efficiency, and improve employee satisfaction—all while ensuring compliance with tax and labor laws.